Sensational Headlines, Simplified Narratives—What’s the Real Story Behind Which?’s Insurance APR Claims?

Which?’s recent article suggests that comparing APRs is the key to understanding the competitiveness and value of insurance premiums. But this view misses the mark, ignoring the complexity and diversity of credit cost structures.Which? calls for urgent FCA action, as research reveals insurers still hitting customers with crippling interest rates for paying monthly – Which? Policy and insight

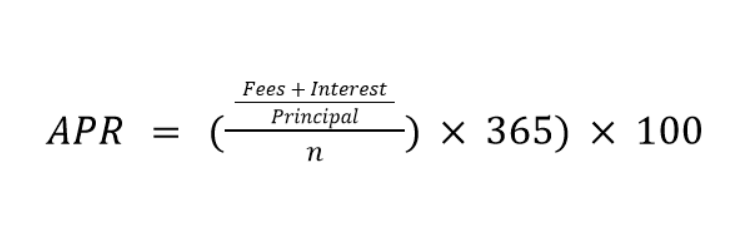

Let’s break it down: Consider two insurers, A and B. Insurer A offers an average premium of £300, while B offers £1,200. Both offer instalment payments at a 20% APR. Is this a fair comparison? Not quite. The fixed costs of onboarding a loan are often similar in absolute terms but vary significantly as a percentage of the premium. For Insurer A, a £300 premium might require a higher flat interest rate just to cover these costs, meaning that 20% APR on a £300 premium could represent greater value than the same APR on a £1,200 premium.

Onboarding costs are just one part of the equation. Specialist premium finance providers use different credit models—Fixed Sum Credit, Running Account Credit—each with their own APR calculation methods, whether real, representative, or based on assumed credit limits. A charge of £100 on a £1,000 premium might result in APRs ranging from 20% to 30%, depending on the calculation method. This complexity makes APRs difficult to interpret, especially in short-term lending scenarios like insurance.

At Tifco, we go beyond superficial comparisons. We help brokers, insurers, and MGAs navigate this complexity, offering a detailed cost analysis to support their rates. For those running their own instalment schemes, we assist in building financial models that reflect the true cost of credit.

In a landscape where quick judgments based on simplified metrics can do more harm than good, understanding the real costs behind insurance credit is essential.

Learn how we can help you make informed decisions.

#Which #Insurance #APR #Brokers #BIBA #ConsumerDuty